Let’s talk LTV to CAC ratio for Shopify stores.

Understanding the relationship between customer lifetime value (LTV) and customer acquisition cost (CAC) is essential for business success. For Shopify merchants, determining the appropriate equilibrium between these two measures can determine whether their business prospers or barely survives.

This blog post will dive into the perfect LTV to CAC ratio for Shopify stores, the variables that can affect this proportion, and the significance of payback time.

What is good LTV to CAC Ratio for eCommerce?

While there is no one-size-fits-all ideal LTV to CAC ratio as it depends on various factors, the good LTV: CAC ratio for eCommerce is 3 to 1.

In other words, for every dollar spent on customer acquisition, your business should generate a minimum of three dollars in revenue.

If your company can achieve a ratio of 5:1, it suggests that you are well-positioned to scale up your operations.

LTV to CAC Ratio Benchmark

Naturally, LTV to CAC ratios exhibit some variability depending on multiple factors, such as industry dynamics and target audience.

Empirical data suggests that a range of 2:1 to 4:1 is considered acceptable in many cases.

Nevertheless, continuous improvement and striving for a higher LTV to CAC ratio are essential for ensuring long-term business stability and growth potential.

The Importance of Payback Time

In marketing, “payback time” refers to the period it takes for a company to recoup the cost of acquiring a customer through their marketing efforts. Payback time is often discussed with Customer Lifetime Value (LTV) and Customer Acquisition Cost (CAC).

In other words, payback time refers to the time it takes for a business to recover its CAC through revenue generated by a customer.

Achieving a desirable LTV to CAC ratio is only half the battle – it’s equally important to reach this ratio within a reasonable timeframe. For instance, a 3:1 ratio achieved in 3 months is far more favorable than the same ratio achieved in 3 years.

Introducing Lebesgue: AI CMO

To assist e-commerce store owners in navigating the multifaceted world of LTV and CAC, we have developed Lebesgue: AI CMO, a state-of-the-art software solution.

Lebesgue efficiently identifies your top-performing products and marketing channels, subsequently providing data-driven recommendations to enhance your marketing strategy.

By incorporating Lebesgue into your business operations, you can optimize your LTV to CAC-ratio and payback time, positioning your enterprise for a competitive edge and long-term profitability.

Further Considerations

It is crucial to acknowledge that while the LTV to CAC ratio and payback time are significant metrics, they are part of a broader spectrum of factors that contribute to the overall success of your Shopify store.

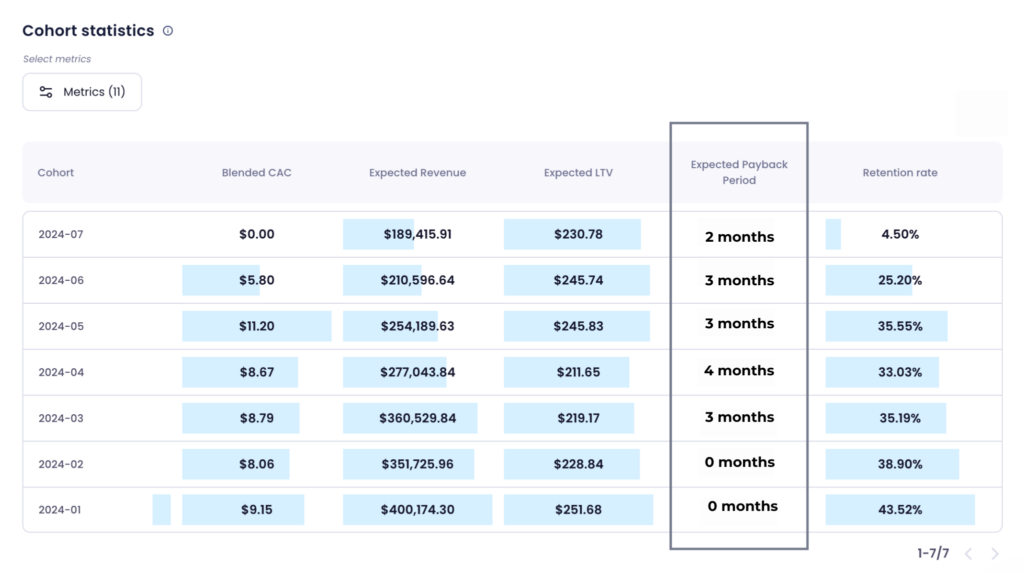

Conducting regular cohort analyses, keeping track of customer churn rates, and monitoring marketing channel performance are essential practices for maintaining a data-driven approach to business growth.

Summing Up

A profound understanding of the LTV to CAC ratio and its impact on business sustainability is indispensable for Shopify store owners.

By targeting a minimum 3:1 ratio, closely monitoring payback time, and leveraging AI-driven tools like Lebesgue: AI CMO, you can establish a solid foundation for your e-commerce enterprise, ultimately paving the way for ongoing success and expansion.