Maximize Your Growth with Shopify LTV App:

Lebesgue AI CMO

Understand and grow your customer lifetime value (LTV) with AI-powered insights.

Key Benefits of LTV Analysis

1

Identify Your Most Valuable Customers

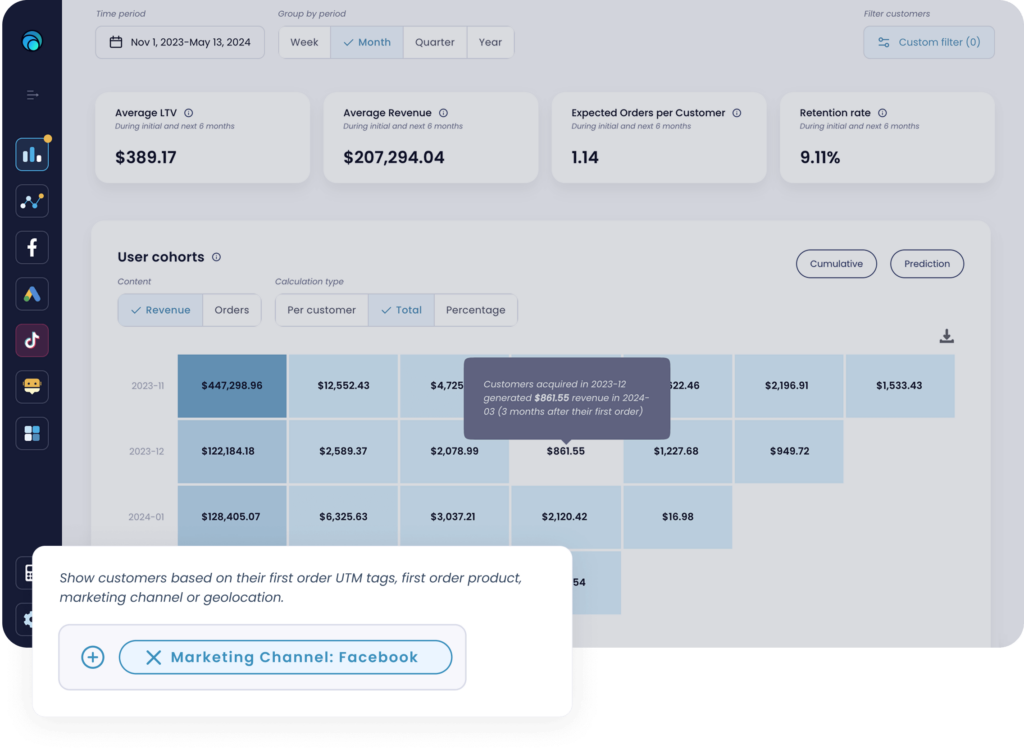

Instantly discover which products, campaigns, and channels attract your highest-value customers.

2

Optimize Your Marketing Channels

See which platforms—Google, Meta, TikTok—drive loyal customers, and shift your budget toward sustainable growth.

3

Tailor Strategies to Regions

4

Analyze Customer Cohorts

5

Make Data-Driven Decisions

6

Discover High-LTV Products

Unlock the full potential of your customer data today!

5000+

businesses using Lebesgue: AI CMO

My overall experience is great, it seems they are always rolling out new features and plugin's so always something new to review and digest. My favorite feature is the LTV and understanding how the LTV is increasing or decreasing over time.

Overall experience has been one of a tool that HELPS keep track of cashflow in the business.

I really like how it breaks down everything revenue, costs, LTV, etc. Great for those running an ecommerce store.

Frequently Asked Questions about Shopify LTV Apps

If you’re looking for the best Shopify LTV app, Lebesgue consistently stands out. Unlike basic calculators, Lebesgue combines accurate customer lifetime value analytics with predictive LTV, CAC vs LTV comparisons, and competitor benchmarks. With 100+ 5-star reviews on the Shopify App Store and highly praised customer support, it’s the top choice for merchants who want reliable insights and actionable data.

Calculating LTV manually requires tracking order frequency, churn rates, margins, and cohorts — which is error-prone and time-consuming. A Shopify LTV calculator app like Lebesgue automates this process, updates data daily, and gives you predictive insights into future customer value. This ensures accuracy while saving hours of manual work.

Both. Lebesgue is first and foremost a powerful LTV calculator for Shopify, giving you clear and accurate customer lifetime value reporting. But it doesn’t stop there — it also shows you which channels bring in your highest-value customers, identifies ad mistakes, and benchmarks your store against thousands of others. That means you’re not just measuring LTV, you’re actively learning how to grow it.

Apps like Lifetimely focus on historical LTV and profit tracking. Lebesgue goes further by combining predictive LTV modeling, competitor analysis, profit dashboards, and ad performance insights. This makes it the most complete Shopify LTV analytics app — helping you connect customer value directly to acquisition strategy.

Yes. Installing the Lebesgue Shopify app takes just a few minutes, and it automatically pulls in your data. Many reviews highlight the exceptional support team, who help merchants customize their LTV dashboards and get actionable insights right away.