Let’s talk about LTV analysis for Shopify store.

Analyzing the customer lifetime value of your Shopify store can be a game-changer when it comes to increasing revenue and growing your business. By understanding how much revenue you can expect from a single customer over their entire relationship with your store, you can make informed decisions about your marketing strategies and customer retention efforts.

In this blog post, we’ll dive into the importance of CLV analysis, how to calculate it for your Shopify store, and provide insights on calculating LTV for subscription-based businesses.

What is Customer Lifetime Value?

The customer lifetime value (CLV) refers to the entire spend that a customer is predicted to make on your business during their entire relationship with your store, including all purchases made and any recurring revenue from subscriptions, memberships, or other ongoing services.

The insight gained from analyzing CLV can help in deciding how much to invest in marketing and advertising efforts to attract new customers, as well as how to retain existing ones.

Why is Customer Lifetime Value Important?

Having a clear understanding of CLV is vital for establishing a profitable and long-lasting business. It allows you to make informed decisions about how much to allocate toward customer acquisition and retention.

If you know that a customer will spend $100 on average throughout their relationship with your store, you can invest more than $100 to acquire them, as long as you have the strategies in place to keep them loyal.

LTV analysis for Shopify store: How to calculate it?

Shopify’s native dashboard does not provide a built-in Lifetime Value (LTV) report. However, you can use third-party apps and integrations, such as Lebesgue: AI CMO, to get detailed LTV reports and gain deeper insights into your customer value over time.

Now, let’s dive deep into the process of calculating CLV for your Shopify store. Follow these steps to calculate the customer lifetime value for your Shopify store:

Step 1: Calculating Average Order Value (AOV) for Your Store

The first step to calculating CLV for your Shopify store is determining your customers’ average order value (AOV).

For better understanding, AOV, or Average Order Value, is the average amount of money spent by customers on each order placed either online or in a physical store.

By dividing the total revenue generated by the total number of orders over a specific period, businesses can determine their AOV. This metric is crucial in understanding customer spending behavior and can be utilized to inform marketing and pricing strategies.

Step 2: Calculating average purchase frequency (APF) for Your Store

The next step in calculating CLV for your Shopify store is to figure out the average purchase frequency. So, what’s APF anyway?

Well, it’s a fancy way of saying how often your customers are making purchases from your store in a given time period, like a month or a year.

To calculate APF, you divide the total number of orders by the total number of unique customers during that specific time period. APF is really important because it gives you an idea of how loyal your customers are and how often they’re returning to your store to buy more stuff.

With this information, you can come up with strategies to keep your customers happy and coming back for more.

Step 3: Calculating average customer lifespan (ACL) for your Store

After calculating AOV and APF, it’s time for the customer lifespan.

Customer lifespan refers to the duration of time that a customer continues to make purchases from a shop before churning or becoming inactive.

It is a measure of customer retention and loyalty and is important for businesses to track in order to understand the longevity of their customer relationships and to identify opportunities for improving retention strategies.

Step 4: Calculating CLV for your Shopify Store

Finally, the last step is to determine the Customer Lifetime Value for your Shopify store.

You just need to multiply your Average Order Value (AOV) by the Average Purchase Frequency (APF), and then multiply the result by the Average Customer Lifespan (ACL).

This calculation will provide you with an approximation of the total revenue you can expect from each customer over the entire duration of their relationship with your business.

For example, let’s say your store has an AOV of $50, an APF of 3 purchases per year, and an ACL of 2 years. Your CLV would be calculated as follows:

$50 (AOV) x 3 (APF) x 2 (ACL) = $300 (CLV)

By using this formula, you can calculate the CLV for each customer segment or cohort, allowing you to make more targeted decisions about marketing and retention strategies-

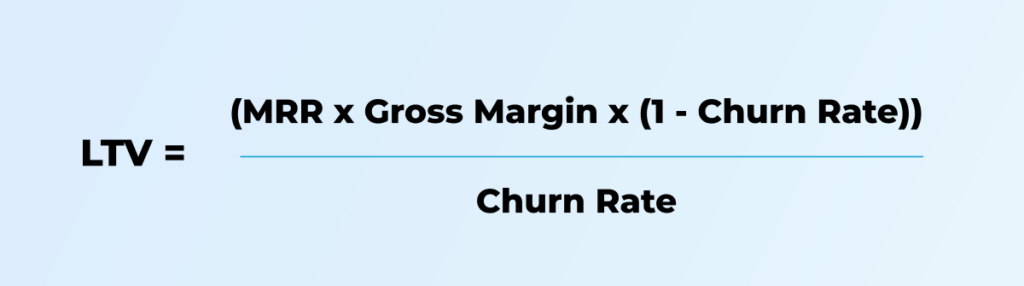

How to Calculate LTV for Subscription-Based Businesses

For subscription-based businesses, calculating LTV can be more complicated. In addition to the factors used in the CLV formula, you’ll need to consider the following:

- Monthly recurring revenue (MRR): This is the amount of revenue that comes from subscription payments each month.

- Churn rate: This is the percentage of subscribers who cancel their subscriptions each month.

- Gross margin: This is the amount of revenue that remains after deducting the cost of goods sold (COGS).

For example, let’s say your subscription business has an MRR of $10,000, a gross margin of 60%, and a churn rate of 5%. Your LTV would be calculated as follows:

LTV = ($10,000 x 0.60 x (1 – 0.05)) / 0.05

LTV = $1,140,000

In this example, the LTV of a subscriber is much higher than the CLV of a non-subscriber, highlighting the importance of understanding LTV for subscription-based businesses.

What is a Good Shopify Retention and Lifetime Value?

As a Shopify store owner, you might be curious about what is considered a good retention rate and lifetime value for your business.

Although there isn’t a universal answer to this question, there are some general principles that can assist you in evaluating whether your retention and LTV metrics are performing well.

Good Shopify store retention

Retention rate refers to the percentage of customers who keep making purchases from your Shopify store during a specific period. A high retention rate means that your customers are loyal and satisfied, while a low retention rate may indicate problems with your product, marketing, or customer service.

Typically, a good retention rate for a Shopify store falls between 25-30%. This implies that around 25-30% of your customers continue to make purchases from your store after their initial purchase.

However, retention rates can vary considerably based on factors such as industry, product category, and customer demographics. For instance, a subscription-based business may have a significantly higher retention rate than a business selling one-time purchases.

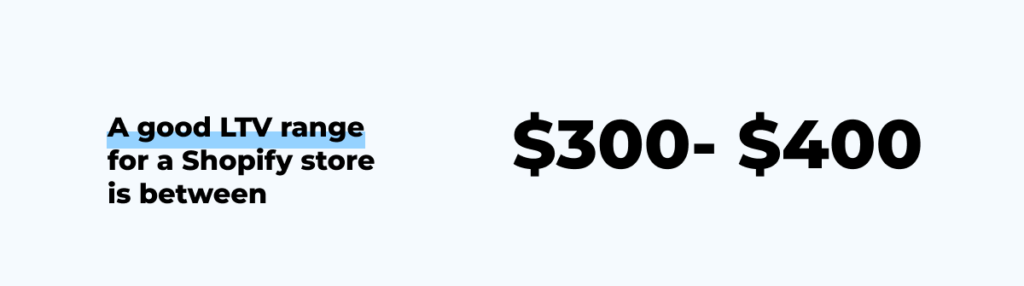

Good Shopify store lifetime value

Your customer lifetime value (LTV) represents the total amount of money that a customer is expected to spend on your Shopify store throughout their entire relationship with your business.

A higher LTV typically indicates that your customers are more valuable and engaged, whereas a lower LTV could indicate issues with pricing, customer service, or marketing efforts.

Generally speaking, a good LTV range for a Shopify store is between $300 to $400.

However, keep in mind that LTV can vary significantly based on various factors such as industry, product type, and customer demographics. For instance, a luxury fashion store is likely to have a much higher LTV than a store that sells discount home goods.

What is a good LTV to CAC ratio

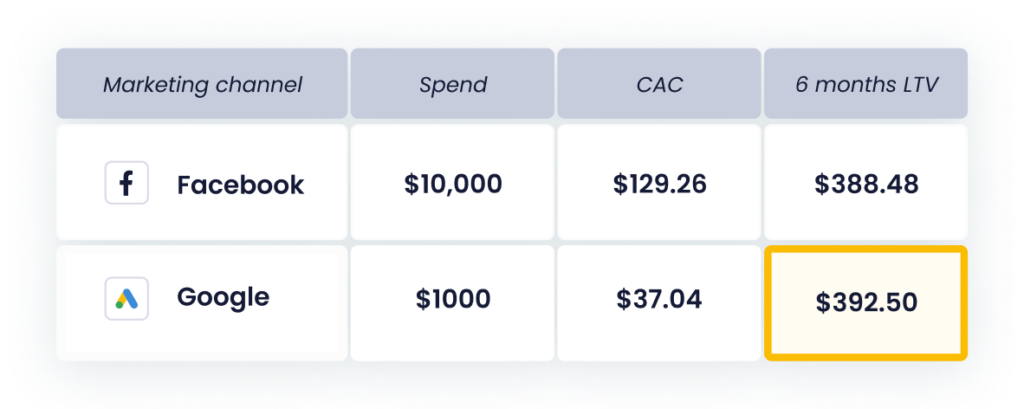

It’s not just about knowing what a good lifetime value (LTV) is for your Shopify store, but also understanding the impact of customer acquisition cost (CAC) on LTV. CAC encompasses all expenses related to marketing, advertising, and sales, and the higher it is, the longer it takes for a customer to generate a positive return on investment (ROI).

A useful metric for assessing the relationship between LTV and CAC is the LTV-to-CAC ratio. This compares the lifetime value of a customer to the cost of acquiring them.

A good LTV to CAC ratio for a Shopify store is at least 3:1, indicating that the lifetime value of a customer is three times greater than the cost of acquiring them. Achieving a 5:1 ratio is a sign that the business is ready to expand.

The LTV to CAC ratio is crucial for understanding the ROI of your marketing and advertising efforts. If your CAC is higher than your LTV, it may be time to reevaluate your marketing strategy and reduce acquisition costs.

On the other hand, if your LTV significantly exceeds your CAC, you may be underinvesting in marketing and missing out on new customer opportunities.

Summing Up

And that’s it. Now, you know how to do LTV analysis for your Shopify store.

LTV analysis will help you make better decisions regarding how much to invest in customer acquisition and retention, by understanding how much revenue you can expect from a single customer throughout their entire relationship with your store.

However, if you prefer to dive deeper and uncover LTV by country, product, UTM tags, discounts, and other breakdowns, you can explore these insights using our Lebesgue: AI CMO.