Triple Whale became a go-to name in the Shopify world for a reason. After iOS 14, when tracking suddenly got fuzzy, it promised exactly what brands were desperate for: clearer attribution, a single source of truth, and a dashboard that pulled everything together.

But as more stores use it, a pattern has emerged. Some merchants feel like they’re paying too much for features they don’t fully use. Others want something simpler, more focused on profit, or more aligned with their specific stage of growth. Quite a few are asking a very reasonable question:

“Is Triple Whale actually the right fit for where we are right now, or is there a better alternative for our size and budget?”

In this blog post, we’ll walk through five Triple Whale alternatives:

- Lebesgue AI CMO (Le Pixel)

- TrueProfit

- Reportgenix

- Northbeam

- Rockerbox

- Hyros

The aim isn’t to crown a universal winner. Instead, we’ll look at what each option does best, what it costs in broad terms, and what kind of Shopify store it really suits.

Why brands start looking beyond Triple Whale

At a high level, Triple Whale is a pixel and attribution platform designed for Shopify brands. It connects store and ad data and uses attribution models to help explain the customer journey. For many teams, especially in the growth stage, that can be valuable.

But four issues commonly push people to explore Triple Whale alternatives. For a deeper breakdown of the differences, you can check our detailed Lebesgue vs Triple Whale comparison.

First, pricing versus stage.

Triple Whale’s pricing typically scales with GMV. Many brands find themselves paying “advanced-tool pricing” long before they’re using advanced capabilities. For teams still refining their marketing strategy, this can feel out of sync with where they are.

Second, feature access and the upsell path.

A significant number of features are locked behind higher-tier plans or add-ons — users often say that as much as 80% of the platform requires an upgrade. In addition, many advanced features aren’t accessible until you complete a sales call with their team.

For merchants who prefer a transparent, self-serve experience — or who simply want to evaluate tools independently — this workflow can feel restrictive.

Third, complexity versus practical decision-making.

Some teams don’t need a full command center of charts. They want clean numbers and direct answers to questions like:

- Which campaigns should we scale?

- Which ones should we cut?

- Where is performance trending this week?

For those brands, simpler, more focused analysis often fits better.

Fourth, support and service experience.

Some merchants have shared that getting consistent, timely support can be challenging — especially when unlocking features requires scheduling calls or navigating multiple touchpoints. Teams that prefer quick, reliable guidance often look for solutions with more straightforward onboarding and responsive customer service.

Altogether, these factors often lead merchants to consider alternatives that offer more transparency, more accessible features, and a workflow that fits how modern eCommerce teams actually operate.

All of that sets the scene for looking at what else is out there.

| Tool | Main focus | Best for | Budget level | Quick takeaway |

|---|---|---|---|---|

| Triple Whale | Pixel + attribution | Growing Shopify brands needing a unified dashboard | Medium–High | Powerful but can feel heavy in pricing and feature gating. |

| Lebesgue AI CMO (Le Pixel) | Shopify-native attribution + AI insights | Brands relying on Meta/Google needing clear first-party attribution | Medium | Links attribution with actionable performance insights. |

| TrueProfit | Real-time profit tracking | Stores scaling ad spend who need profit clarity | Low–Medium | Great way to keep scaling tied to real profit. |

| Reportgenix | Custom reporting + AI forecasting | Small to mid-sized Shopify stores needing simple reporting | Medium | Flexible drag-and-drop reporting with forecasting at an accessible price. |

| Northbeam | Attribution + media-mix modeling | High-spend, multi-channel brands | High | Ideal once you manage big budgets and complex channel mixes. |

| Rockerbox | Unified online + offline measurement | Brands running TV, podcasts, direct mail and digital | High | Strong when you need visibility across non-Shopify + Shopify channels. |

| Hyros | High-accuracy tracking for long funnels | Agencies, info-products, webinar/call-based funnels | High | Designed for complex funnels that standard pixels can’t track well. |

A quick way to think about attribution by store size

Before we dive into individual tools, it’s worth stepping back and asking one simple question: where is your store in its growth journey? The right solution for a scrappy brand testing its first winning offer is very different from what a multi-channel, eight-figure operation needs.

If you’re in the early-stage bucket — let’s say under roughly $50k per month in revenue and spending less than $10k per month on ads — your biggest jobs are to prove product-market fit, find a creative that works, and avoid burning cash. Basic tracking via Shopify, GA4, and the ad platforms, plus a simple profit tool, often gives you enough signal. An expensive attribution suite at this point is usually a nice-to-have rather than a critical one.

As you move into the growing or mid-market stage — somewhere in the ballpark of $50k to $300k per month in revenue, with $10–80k per month in ad spend — the picture changes. Now, turning off the wrong campaign genuinely hurts. You’re juggling Meta, Google, and maybe TikTok, testing lots of audiences and creatives. At this point, a proper pixel and attribution layer starts to pay for itself, because it helps you see which campaigns and channels are actually acquiring new customers and not just recycling existing ones.

Finally, there are scaling and advanced brands, often doing $300k+ per month in revenue with a more complex mix of channels, maybe including offline or upper-funnel media. These companies care deeply about media mix, incrementality, and forecasting. They’re usually the ones who can justify heavy tools like Northbeam or Rockerbox, sometimes paired with a data warehouse and BI stack.

With that in mind, here are the main alternatives.

Lebesgue AI CMO: Shopify-native first-party attribution

Let’s start with the one that’s closest in spirit to Triple Whale for Shopify merchants — but with a broader vision. So, the first Triple Whale alternative that we’ll mention is Lebesgue: AI CMO.

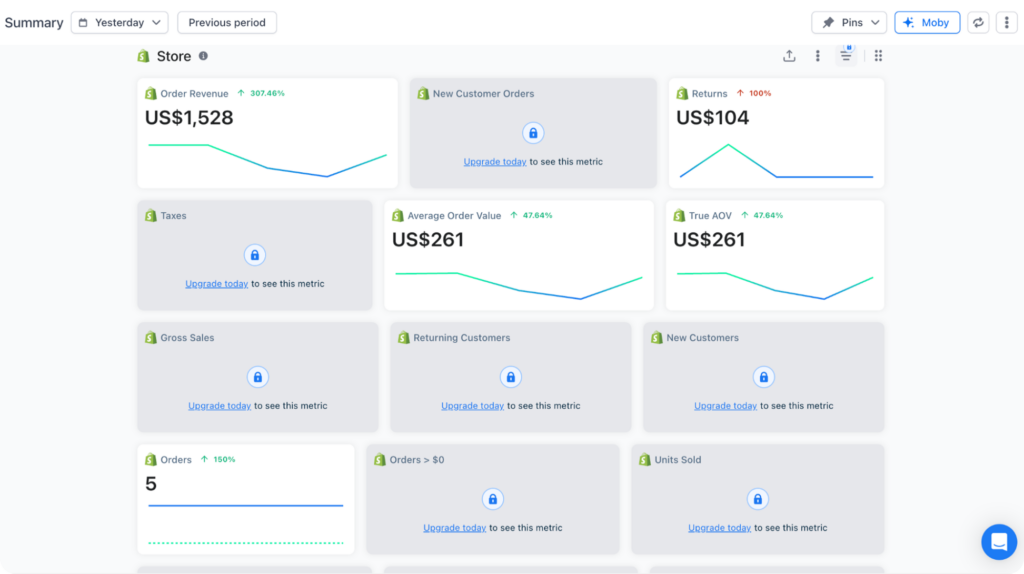

Lebesgue: AI CMO is a full marketing analytics platform for Shopify brands, offering AI-driven insights across ad performance, competitors, and creative strategy. Its Le Pixel feature brings advanced, first-party attribution into that ecosystem — purpose-built for Shopify and seamlessly integrated with the rest of Lebesgue’s analytics.

You install Le Pixel as a Shopify app, connect your ad platforms, and it starts collecting first-party data to give you a cleaner, more accurate view of what your campaigns are actually doing.

What sets Le Pixel apart is its focus on first-party and server-to-server tracking. Rather than relying on fragile browser events, it ties conversions back to marketing efforts through more resilient data flows — a major upgrade over taking ad-platform numbers at face value.

The experience goes beyond raw tracking. Le Pixel helps you easily distinguish new vs. returning customers by campaign and channel, an essential insight for any growing brand. A campaign might look great on revenue, but if it’s mostly driving repeat buyers, that’s a signal to rethink your budget.

Because Le Pixel lives inside the Lebesgue: AI CMO platform, attribution data doesn’t exist in isolation — it powers actionable insights and recommendations that answer practical questions: Which campaigns are truly profitable? Where can we trim spending? Which creative or audience deserves more budget? The result isn’t just another dashboard, but an attribution layer wired directly into your decision-making.

Pricing-wise, you don’t pay separately for Le Pixel — it’s included in your Lebesgue plan, alongside all other analytics and AI features. That means reliable first-party attribution comes built-in, not as an extra cost or add-on. For Shopify brands spending in the low- to mid-five figures per month on ads, it’s a natural step up from raw ad-manager data — a balanced, affordable alternative to enterprise-level attribution tools like Triple Whale.

TrueProfit: start with profit, then worry about attribution

While Le Pixel and Triple Whale are both attribution-first products, TrueProfit comes at the problem from a different direction. It asks a simpler, more fundamental question: are you actually making money?

TrueProfit connects to your Shopify store and ad platforms and pulls in the things that truly matter for your bottom line: revenue, ad spend, product costs, shipping, transaction fees and other expenses. Instead of viewing success through ROAS alone, you get a clear picture of real-time net profit. You can see how profitable different products, campaigns and time periods are once everything is taken into account.

This approach can be especially valuable for early and mid-stage brands who might not be ready to invest in a full attribution suite, but who definitely want to avoid scaling unprofitable campaigns. By pairing basic attribution from native tools with a live view of profit, you give yourself a more grounded way to make decisions.

Pricing-wise, TrueProfit sits in the lower part of the spectrum. It’s typically closer to what you’d expect from a Shopify utility app rather than a complex measurement platform. That makes it accessible for smaller stores that still need better numbers, but don’t have the budget or the need for heavy models.

The limitation is that TrueProfit doesn’t aim to be a multi-touch attribution engine in the way Le Pixel, Triple Whale, Northbeam or Rockerbox do. It’s not trying to reconstruct every step of the customer journey across channels. Instead, it’s a profit copilot: something that keeps your scaling decisions tethered to reality.

For many Shopify brands, a sensible path looks like this: start by getting profit visibility with a tool like TrueProfit, then, once ad spend and complexity grow, layer in first-party attribution through a pixel like Le Pixel.

Reportgenix: flexible reporting for small to mid-sized Shopify stores

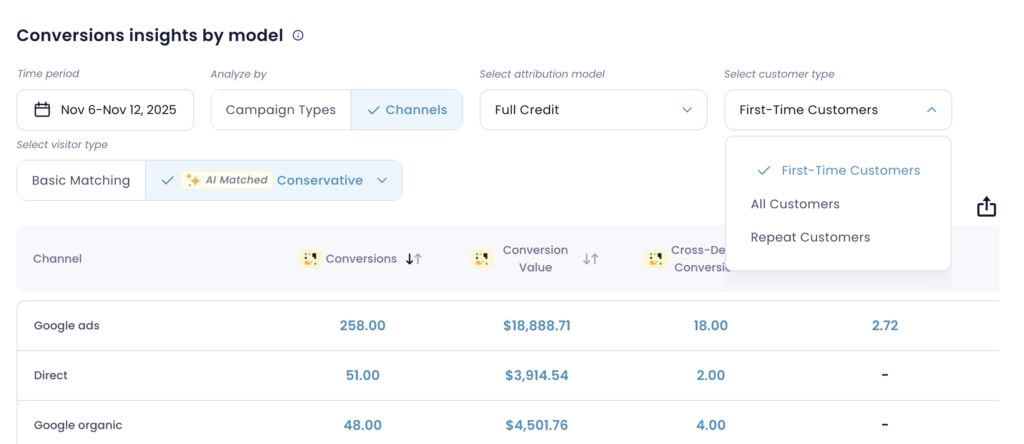

Reportgenix is another Triple Whale alternative focused on giving Shopify merchants clear, flexible reporting without a heavy price tag. The app lets you create and schedule custom reports for your store, so you can keep a consistent pulse on performance instead of pulling numbers manually.

At its core, Reportgenix offers an all-in-one dashboard with real-time updates and insights. You can track your store’s sales and overall performance, monitor sales, revenue, and live trends from a single view, and then customize what you see using a drag-and-drop builder. That builder makes it easy to design custom reports and dashboard layouts around the specific metrics that matter to your business.

On top of standard reporting, Reportgenix includes an AI assistant called Genix AI. It’s designed to forecast sales trends and customer behavior based on your store data, helping merchants make smarter decisions around growth and store optimization.

The app also integrates with Slack to help teams manage and stay on top of their data. According to their roadmap, integrations with Google Analytics, Meta, WhatsApp, Discord, Telegram, and Instagram are planned, which would further centralize performance insights in one place.

TrueProfit: start with profit, then worry about attribution

At the other end of the spectrum sits Northbeam, a platform built for brands that already operate at a significant scale and need more than just “which campaign got the last click”.

Northbeam is an advanced attribution and measurement platform that combines multi-touch attribution with media-mix modeling and forecasting. The idea is to give you a much richer view of how channels and campaigns interact over time, and how shifting budget between them is likely to affect performance.

Instead of relying purely on what Meta or Google report, Northbeam uses first-party and modeled data to offer its own view of performance that spans paid social, search, email and more. For mature brands that have large budgets spread across channels, that can be a powerful way to cut through noise and make more confident allocation decisions.

This level of sophistication comes with enterprise-level pricing. Publicly available information and reviews commonly place Northbeam plans in the four-figure-per-month range, scaling with website traffic and complexity. That’s before considering the internal cost of having people who know how to interpret the data and build it into planning.

In practice, Northbeam makes the most sense for DTC and e-commerce businesses with high six-figure or seven-figure ad budgets and a marketing team that is prepared to spend time in the tool. If you’re still spending in the low five figures per month and mostly playing in Meta and Google, it’s almost certainly overkill.

For those larger brands, though, Northbeam is one of the strongest Triple Whale alternatives precisely because it goes far beyond the command-center dashboard model and into deeper modeling of the marketing mix.

Rockerbox: unified measurement for complex, multi-channel brands

Rockerbox is another tool that sits in the “serious measurement infrastructure” camp, but with its own twist. While Northbeam is heavily focused on ecommerce and digital channels, Rockerbox puts a lot of emphasis on unifying online and offline marketing in a single measurement framework.

The platform combines multi-touch attribution with Marketing Mix Modeling (MMM) and incrementality testing. In practice, that means it doesn’t just try to attribute conversions to clicks; it also aims to show how all of your activities — from Facebook to TV to podcasts — contribute to overall performance. If you’re sponsoring podcasts, running OTT or connected TV ads, testing direct mail, and driving people back to a Shopify store, that kind of holistic view is hard to get elsewhere.

Rockerbox integrates with Shopify to ingest order data, but it’s clearly built with more complex, multi-channel advertisers in mind. As with Northbeam, the pricing reflects that. Plans are typically in the high hundreds to thousands per month range, and the platform assumes you have a certain level of sophistication and bandwidth on the measurement side.

For a standard Shopify brand spending most of its budget on Meta and Google, Rockerbox is usually more than you need. It becomes a strong Triple Whale alternative only once you’re running a genuinely broad media mix and need a tool that can treat all of those channels as first-class citizens in your measurement strategy.

Hyros: hardcore tracking for complex funnels

Finally, there’s Hyros, a platform that has become popular with performance marketers, agencies and info-product businesses that run sophisticated funnels.

Hyros is built around high-accuracy tracking and attribution. It follows users across devices and sessions, then attributes revenue back to campaigns and ads more precisely than basic pixel setups. One of its major selling points is its ability to send clean, server-side conversion data back into Meta, Google, TikTok and other ad platforms, helping their algorithms optimize more effectively.

Where Hyros really shines is in complex funnels. If your customer journey includes webinars, phone calls, long video sales letters, multiple upsell paths and recurring subscriptions, you quickly hit the limits of standard pixel tracking. Hyros is designed to deal with those kinds of flows and make sense of what’s actually working.

It does integrate with Shopify and can be used for ecommerce, but its heritage is more in info-products and funnel-heavy businesses. Pricing is typically in a premium band, often quoted directly rather than displayed on a public pricing page, and tends to land in the higher multi-hundred to four-figure range depending on setup.

For a classic Shopify brand with a relatively straightforward path from ad click to product page to checkout, Hyros can certainly work, but it may be more than you strictly need. In that case, a Shopify-native attribution layer like Le Pixel is usually a better first step.

Do small and medium Shopify stores really need any of this?

All of this raises a question: if you’re not a seven-figure ad spender with a full marketing team, do you actually need an attribution platform at all?

For many small stores, the answer is: not yet. If you’re spending less than around $10,000 a month on ads, the biggest levers are usually your product, your offer, and your creative. Cleaning up your tracking in Shopify, GA4 and the ad platforms, making sure events are firing correctly, and keeping an eye on basic profit often yields more value than dropping a large chunk of budget on analytics.

However, as soon as you enter that mid-range — the stage where turning the wrong campaign off would meaningfully dent your revenue — things change. When you’re testing more creatives, audiences and channels, and your Meta dashboard says one thing while Google claims another, guessing based on whichever number you like more becomes risky.

That’s the moment where a focused, Shopify-native tool like Le Pixel or a solution like Triple Whale starts to make sense. The decision is less about having fancy attribution diagrams and more about reducing the number of expensive mistakes you make when scaling and cutting campaigns.

Choosing the right Triple Whale alternative

When you’re deciding which path to take, it helps to strip it back to three questions.

1. What’s your main outcome?

- If your priority is cleaner attribution for Shopify paid channels and a clear view of which campaigns actually acquire new customers, then starting with Lebesgue’s attribution layer — powered by Le Pixel — makes a lot of sense.

- If you mainly care about tracking profit and unit economics as you grow, a profit-focused app like TrueProfit may come first, with attribution layered in later.

- If your goal is simply to get clearer reporting without a big learning curve or a large software commitment, a lightweight tool like Reportgenix can be a good fit. Its drag-and-drop reports, real-time dashboards, and Genix AI forecasting make it easy for smaller teams to understand performance and monitor trends.

- If you’re already a large, multi-channel brand thinking in terms of media mix and incrementality, that’s when Northbeam or Rockerbox deserve a serious look.

And if your funnels are complex and high-touch, Hyros may be worth the extra implementation effort.

2. What’s your realistic budget?

- If you want to stay under about $100/month, you’re in the territory of TrueProfit or Reportgenix, both of which offer accessible pricing and core insights without requiring a major investment.

- At a few hundred dollars per month, you can step up to Lebesgue, which includes first-party attribution via Le Pixel alongside broader analytics and AI insights.

- Once you’re ready to invest four figures or more per month — and have the team to match — that’s when Northbeam, Rockerbox, or Hyros come into play.

3. Who will actually use it?

- If there’s no one on your team ready to dive into dashboards regularly and act on the data, a highly complex platform will just gather dust.

- In that case, you’re better off with a tool that surfaces clear, opinionated insights and fits into your existing workflows rather than something that demands constant manual analysis.

This is exactly where Lebesgue with Le Pixel fits best: Shopify brands too big to rely on gut feeling and ad-platform ROAS alone, but not so big that they need an analyst just to interpret their attribution data.

Summing Up

There’s no universal “best” Triple Whale alternative — and any article that claims otherwise is probably selling more than it’s informing.

Your store’s size, spend, channel mix, and internal resources all matter.

That said, most Shopify brands sit in the middle. They’re not side projects with tiny ad budgets, nor are they enterprises with TV campaigns and data teams. They’re serious about growth, rely heavily on Meta and Google, and know that poor campaign decisions can get expensive fast.

For those brands, Lebesgue’s attribution — powered by Le Pixel — is a natural fit.

It provides a Shopify-native, first-party view of your marketing performance, makes it easy to see which campaigns actually acquire new customers, and does so at a price point that fits real-world Shopify brands, not unicorns.

If you’re in that “too big for guesswork, too small for a measurement department” zone — and Triple Whale feels misaligned in price, philosophy, or complexity — testing Lebesgue with Le Pixel as your attribution layer is often the most logical next step.

If you want a side-by-side look at how Lebesgue compares, you can read our full Lebesgue vs Triple Whale breakdown here.

Frequently Asked Questions about Triple Whale Alternatives

The best alternative depends on your store’s size and complexity. For most growing Shopify brands running Meta and Google ads, Le Pixel is the most practical alternative because it offers first-party attribution, new vs. returning customer clarity, and flat $99/month pricing. Larger multi-channel brands may benefit from advanced tools like Northbeam or Rockerbox.

Not always. If you’re spending under $10k/month on ads, your biggest wins usually come from improving product-market fit, creative quality, and basic tracking. Most early-stage stores can delay attribution tools until scaling feels risky or platform numbers start giving conflicting signals.

It can be—especially for mid-sized Shopify stores that want a centralized view of performance. But not every brand needs the full Triple Whale suite. Alternatives like Le Pixel offer clearer first-party tracking at a lower, predictable cost, while profit tools like TrueProfit help you focus on financial health before upgrading.

First-party attribution uses your store’s own data, collected and processed server-side. It’s more reliable after iOS 14 because it doesn’t depend as heavily on browser tracking. Tools like Le Pixel lean on first-party and server-side data to rebuild a clearer customer journey than ad platforms alone.

For stores that want attribution without enterprise pricing, Le Pixel’s $99/month flat rate is one of the most cost-effective options. If you only need profit visibility, tools like TrueProfit offer an even lower-cost starting point.

Upgrade only when:

- You’re running multiple channels beyond Meta and Google

- You’re spending $80k+/month on ads

- You need MMM, incrementality testing, or forecasting

- You have someone on your team who will actually use the data

Otherwise, these heavier tools usually exceed what most Shopify brands need day-to-day.

You’re ready if:

- You’ve scaled past $10k–$15k/month in ad spend

- Meta and Google numbers don’t match and cause confusion

- You’re making decisions that meaningfully impact revenue

- You want to understand which campaigns bring in new customers, not just revenue

If those describe your situation, a tool like Le Pixel can save budget and increase clarity quickly.